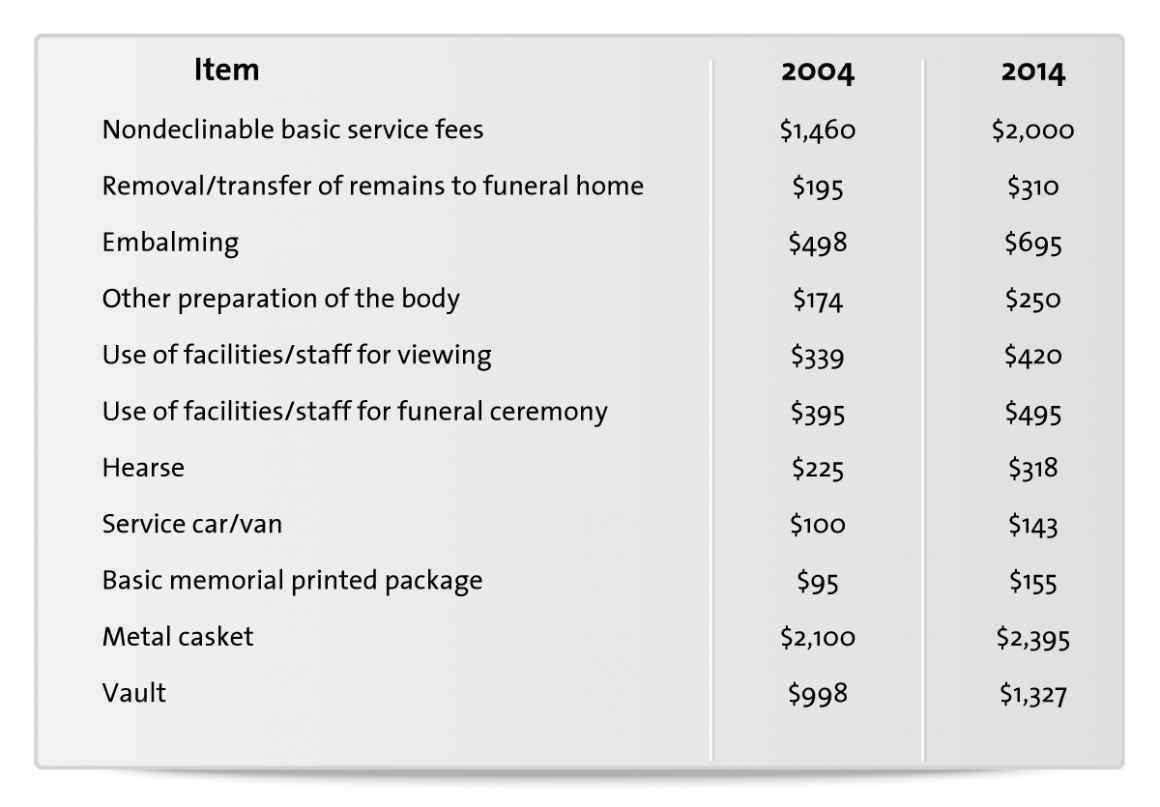

2 A Final Expense policy can prevent your loved ones from covering the cost of your funeral and experiencing a financial burden during the stressful time of losing you. If you (or your spouse) own life insurance polices or have other burial arrangements in addition to your 1,500 burial funds, some of the money in the burial. Social Security only offers a $255 one-time payment to the surviving spouse or an eligible child. Below is just a sample of some genuine Choice Mutual reviews from happy customers. These policies are made to protect family and loved ones from the financial burden after one passes away. It provides lower benefit amounts than other kinds of life insurance, typically providing between 2,000-25,000 in coverage. Call us at 1-80 or use our quoting tool to get started. Burial insurance is a smaller, guaranteed whole life insurance policy used to cover funeral or burial costs. Your focus now should be to prepare for covering any expenses that you will leave behind for your loved ones when you pass.Ī traditional funeral can easily cost more than $10,000, 1 according to the National Funeral Directors Association. Our agents are friendly, will answer all your questions, are never pushy, and allow you to choose when and if you buy a policy.

Your life insurance needs change once you retire, have paid off the mortgage, and your children are out of the house. If you want to buy life insurance purely to cover your funeral or cremation costs and other end-of-life expenses, look into our burial insurance plans. These policies are important for families when you’re still working, paying a mortgage, making car payments and raising kids. The Funeral Consumers Alliance (FCA), a death-care industry watchdog group, advises against buying pre-need and burial insurance, because you’ll often pay as much or. Traditional life insurance policies, such as term policies, are designed to replace any income lost when a loved one dies. There’s also burial insurance, which is a policy intended to pay death-related costs, and pre-need insurance, a policy intended to cover a predetermined amount for a funeral. It’s just that simple.Īpply Now Get a Quote I’m interested, but need to know moreįinal Expense Insurance is different from other life insurance. In less than 15 minutes you can own a guaranteed-issue Final Expense Life Insurance policy. Burial insurance or final expense insurance is a basic life insurance policy that typically covers people until they reach the age 100. All guarantees are based on the claims paying ability of the underwriting company. Insurance products are issued by CMFG Life Insurance Company, MEMBERS Life Insurance Company, CUMIS Insurance Society Inc., CUMIS Specialty Insurance Company Inc., American Memorial Life Insurance Company, and Union Security Insurance Company.The application process is easy. The burial insurance benefit is a modest payout that your beneficiaries can spend as they wish. Investment and insurance products are not federally insured, may involve investment risk, may lose value andĪre not obligations of or guaranteed by any depository or lending institution. SIPC, a registered broker/dealer, 2000 Heritage Way, Waverly, IA, 50677. There are no limitations in terms of health history or medical history. There are certain limitations, exceptions, and state law requirements for those 0 to 50, however, so the ideal time to get burial insurance is when you are age 50 or up. its subsidiaries and affiliates. Securities distributed by CUNA Brokerage Services, Inc., member FINRA/ Burial insurance, or final expense insurance, is for anyone between the ages of 0 and 85.

BURIAL INSURANCE HOW TO

Here’s how to buy burial insurance for a parent, step by step. It can be anxiety-producing, and there are quite a few things for you to consider. Buying burial insurance for a parent isn’t as easy as it may sound. TruStage™ is the marketing name for TruStage Financial Group, Inc. Burial insurance is an insurance purchased to cover the cost of burial, cremation or other disposal of a deceased remains. Steps for Purchasing Burial Insurance for a Parent.

0 kommentar(er)

0 kommentar(er)